All Categories

Featured

Table of Contents

[/image][=video]

[/video]

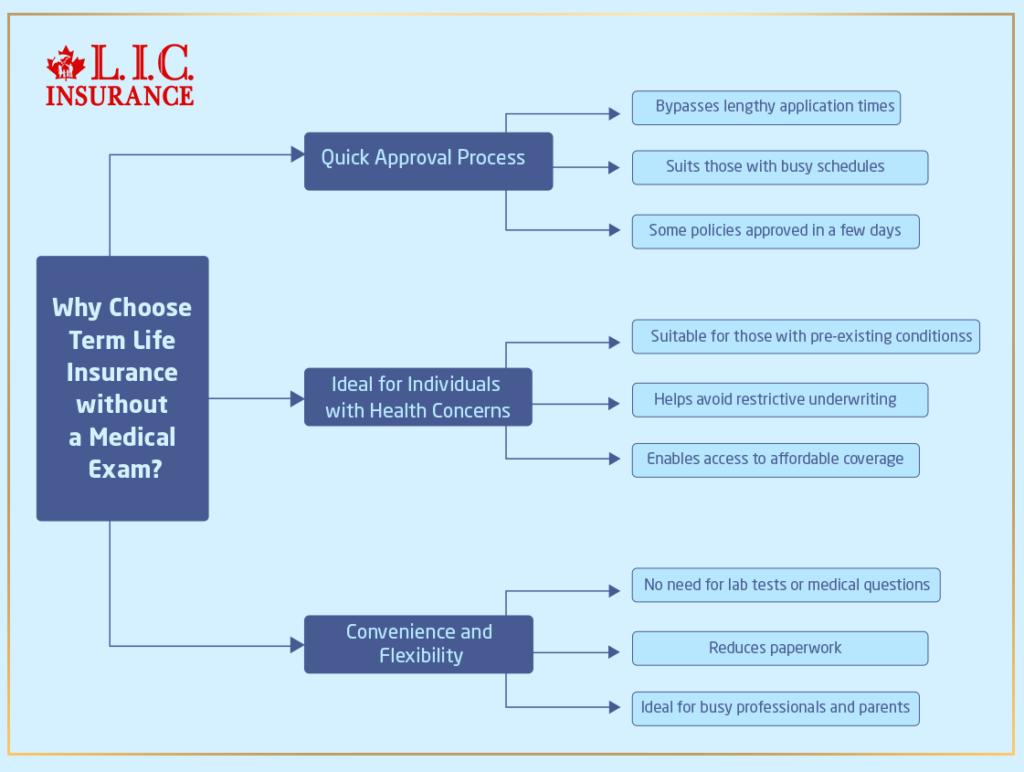

If you're in good health and wellness and prepared to go through a clinical test, you might certify for standard life insurance coverage at a much reduced price. Surefire issue life insurance coverage is usually unneeded for those in good health and wellness and can pass a medical test.

Given the lower protection amounts and higher costs, assured concern life insurance policy might not be the most effective choice for lasting economic preparation. It's usually a lot more suited for covering last costs as opposed to replacing income or significant debts. Some ensured problem life insurance coverage policies have age restrictions, usually restricting candidates to a specific age range, such as 50 to 80.

Guaranteed problem life insurance comes with higher premium expenses compared to clinically underwritten plans, however rates can vary significantly depending on aspects like:: Various insurance firms have different pricing designs and may use various rates.: Older applicants will certainly pay higher premiums.: Ladies frequently have lower rates than males of the exact same age.

: The survivor benefit quantity impacts costs. A $25,000 plan prices less than a $50,000 policy.: Paying premiums month-to-month costs much more total than quarterly or yearly payments.: Whole life premiums are higher general than term life insurance policy policies. While the guaranteed issue does come at a rate, it offers vital coverage to those who might not qualify for generally underwritten plans.

Surefire issue life insurance policy and simplified concern life insurance are both kinds of life insurance coverage that do not need a medical examination. There are some essential distinctions in between the 2 kinds of plans. is a kind of life insurance policy that does not require any type of health inquiries to be answered.

Life Insurance - Truths

Guaranteed-issue life insurance coverage plans typically have greater premiums and lower fatality benefits than conventional life insurance plans. The health questions are usually much less detailed than those asked for standard life insurance policy plans.

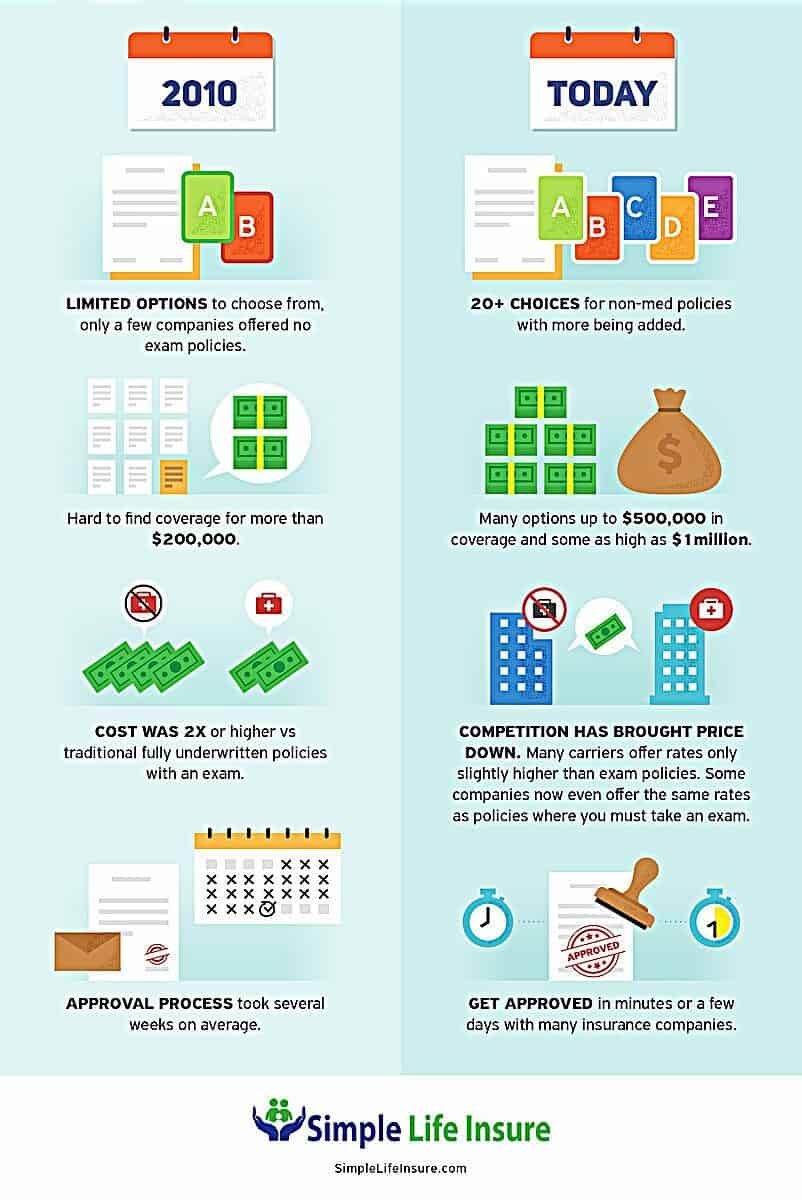

Immediate life insurance coverage is protection you can obtain an immediate solution on. Your policy will start as soon as your application is accepted, suggesting the entire procedure can be done in less than half an hour.

Lots of internet sites are encouraging instant coverage that starts today, however that does not mean every candidate will qualify. Usually, clients will certainly submit an application believing it's for immediate insurance coverage, only to be fulfilled with a message they need to take a medical examination.

The very same info was then made use of to approve or reject your application. When you use for an accelerated life insurance coverage plan your information is analyzed quickly.

You'll then obtain immediate approval, split second being rejected, or observe you need to take a clinical exam. You might need to take a medical examination if your application or the data drew about you expose any kind of health problems or worries. There are numerous alternatives for instant life insurance coverage. It is essential to keep in mind that while many standard life insurance policy companies deal accelerated underwriting with quick authorization, you could need to undergo a representative to apply.

Indicators on Guaranteed Acceptance Life Insurance - No Waiting Period! You Need To Know

The firms below deal entirely on-line, straightforward options. The business offers flexible, instant policies to people in between 18 and 60. Ladder policies allow you to make modifications to your coverage over the life of your plan if your needs transform.

The company offers plans to applications in between 21 and 55 for a ten-year term, and between 21 and 45 for a 20-year term. You'll obtain an instant choice from Bestow. There are no medical examinations needed for any type of applications. Principles plans are backed by Legal and General America. The company does not provide policies to homeowners of New york city state.

Just like Ladder, you might require to take a medical test when you request coverage with Principles. Nevertheless, the firm claims that most of candidates can obtain protection without an exam. Unlike Ladder, your Ethos policy will not start immediately if you require an exam. You'll need to wait until your exam outcomes are back to get a rate and buy insurance coverage.

In other situations, you'll need to supply more information or take a medical test. Below is a price comparison of insant life insurance for a 50 year old male in excellent health.

Many people begin the life insurance acquiring plan by obtaining a quote. Allow's claim you got a quote for $50 a month for a $500,000, 20-year policy.

You can establish the exact coverage you're applying for and then start your application. A life insurance coverage application will ask you for a lot of information.

The Ultimate Guide To The Best No Medical Exam Life Insurance Companies For ...

If the company discovers you really did not disclose info, your policy can be denied. The decline can be reflected in your insurance coverage rating, making it harder to obtain protection in the future.

A streamlined underwriting plan will certainly ask you comprehensive concerns about your clinical background and current medical care throughout your application. An instantaneous problem policy will certainly do the exact same, however with the difference in underwriting you can get an instant choice.

Second, the coverage quantities are lower, however the costs are often higher. And also, guaranteed problem plans aren't able to be utilized during the waiting period. This suggests you can't access the full death advantage amount for a collection quantity of time. For a lot of policies, the waiting duration is two years.

Yes. If you're in health and can qualify, an immediate issue policy will enable you to get insurance coverage with no test and no waiting duration. Suppose you remain in less than ideal wellness and desire a plan without waiting duration? In that case, a streamlined issue policy without exam could be best for you.

Indicators on Life Insurance Without A Medical Exam - New York Life You Should Know

Bear in mind that simplified problem plans will certainly take a couple of days, while instantaneous plans are, as the name indicates, instant. Acquiring an immediate policy can be a rapid and simple procedure, but there are a couple of points you ought to view out for. Prior to you hit that purchase switch make certain that: You're buying a term life plan and not an unintentional death plan.

They don't provide coverage for disease. Some firms will issue you an unintentional death policy instantly however require you to take an exam for a term life policy.

Your agent has addressed all your concerns. Similar to web sites, some representatives stress they can obtain you covered today without explaining or supplying you the info you require.

Table of Contents

Latest Posts

Some Known Facts About No Medical Exam Life Insurance.

Unknown Facts About Guaranteed Issue Life Insurance: Up To $25000 In Coverage

Compare No Exam Life Insurance Quotes Instantly Things To Know Before You Get This

More

Latest Posts

Some Known Facts About No Medical Exam Life Insurance.

Unknown Facts About Guaranteed Issue Life Insurance: Up To $25000 In Coverage

Compare No Exam Life Insurance Quotes Instantly Things To Know Before You Get This